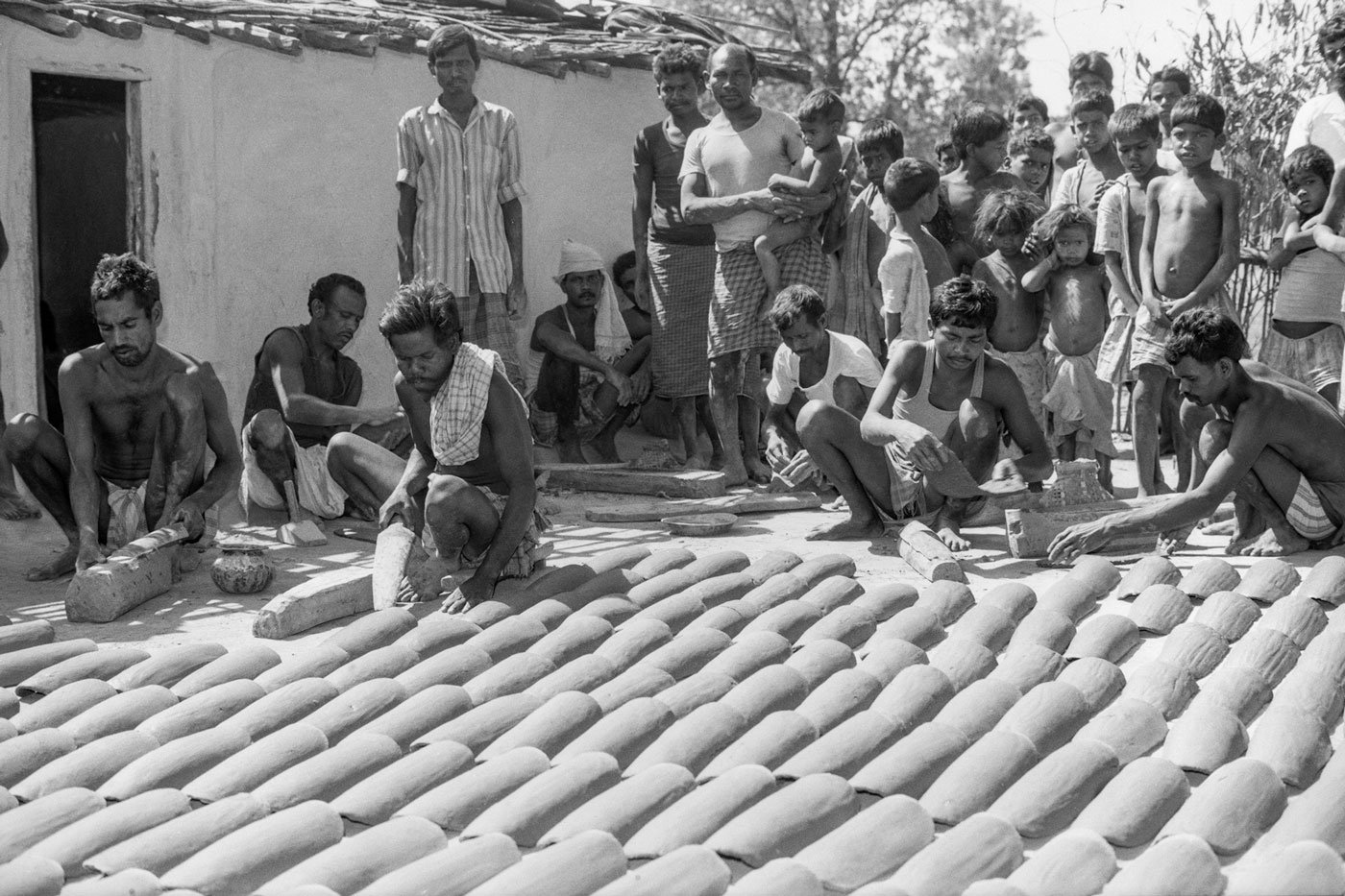

The entire Bamdabhaisa mohalla had turned out to help make tiles for Nahakul Pando. It was a show of solidarity, a community effort where people who took turns at tile-making were working gratis – if you overlooked the small quantities of home-made wine that Nahakul passed around.

But why were they making tiles for his roof? And how the heck did he lose the ones that were there in the first place? A glance at his home showed the main structure to be bald in big patches, with whole sections of tiles missing.

“It was a sarkari loan,” he said, wearily. “I borrowed 4,800 rupees and bought two cows.” Which was the core of the official scheme – ‘soft loans’ – amounts that included a subsidy component, and a low-interest loan component, if you went in for cows. And, you could actually buy two cows for that amount in this part of Surguja in 1994. (The district was then in the state of Madhya Pradesh and is now in Chhattisgarh.)

Nahakul had not originally been fired up by the idea of borrowing anything at all. Quite a few members of the Pando Adivasi group he belongs to had become wary of loans as, in their experience, those often led to them losing their lands. But this one was a government loan, specially disbursed through the local bank for the exclusive benefit of Adivasis. Which meant there couldn’t be much harm in accepting it. As the old line goes – it seemed a good idea at the time.

“But I could not repay it,” said Nahakul. The Pandos are a very poor people, classified as a ‘Particularly Vulnerable Tribal Group’. Nahakul is no exception to their general condition.

“There was pressure to pay the instalments,” he told us. And a lot of scolding from bank officials. “I paid off a bit by selling different things. Finally, I sold the tiles on my roof to raise what little I could from those.”

The loan that was to liberate Nahakul from poverty ended up costing him his roof. Literally. He did not have the cows any longer, either – he had to sell those too. While Nahakul had believed the scheme was for his benefit, he was really just a ‘target’ to be achieved. We learned later that others around here, mostly poor Adivasis, had also experienced this programme and punishment.

“Nahakul and the others did need the money they borrowed under this scheme – but they could not get it for the things they wanted,” said advocate Mohan Kumar Giri, who had accompanied me to a few villages in his native Surguja. “They had to take it for schemes that had no relevance to their needs. Normally, you take a loan to save the roof over your head. Nahakul took a loan that made him lose his. Now do you understand why so many people still go to the moneylender?”

The two of us left casting admiring glances at people who seemed to make fine tiles emerge magically from the characterless clay in their skilled hands. Another two of our group left casting envious glances at the tile makers consuming what looked like a very inviting wine.

From the story ‘Take a loan, lose your roof’ originally published in Everybody Loves a Good Drought – but without these original photos that I have since recovered.